Assessment Model Review

POST #5 ARMAA Update on March 20, 2025:

ARMAA continues to participate in the Assessment Model Review. The process is currently focused on the Construction Cost Reporting Guide (CCRG). The Technical Working Group (TWG) is generating information and suggestions for consideration by the Steering Committee. Mike Haugen (Kneehill County) and Matt Fenske (County of Newell) are handling Steering Committee duties and Larry Riep (Lacombe County) is representing the organization on the Technical Working Group. Other municipal involvements are also occurring via other municipal agencies and include representatives from County of St. Paul, MD of Bonnyville, Sturgeon County, and Strathcona County.

A concern to ARMAA (and other municipal members) is that a parallel discussion on the concept of “value” is being facilitated within the process. Our view has been that the purpose, as defined in the Project Charter, is to determine a property’s assessed value based on the costs of construction, modified to exclude certain costs that are unusual. The discussion of value, particularly in view of utility, is not aligned with this purpose. This discussion is being pushed by other non-municipal stakeholders as a way of pushing towards a new way of measuring value that includes utility and level of production. We are seeing ideas floated that include assessment based solely on material cost, suggestions leading towards a market value approach, and exclusion of costs related to regulatory factors such as safety, legislative, etc. All of these are concepts that ARMAA and all of the other municipal entities are significantly pushing back on.

Discussions on these topics are ongoing throughout March and April.

ARMAA President

POST #4 ARMAA Update on October 18, 2024:

ARMAA continues to be a part of the Assessment Model Review process. ARMAA has a seat on the AMR Steering Committee which is currently Mike Haugen (Kneehill County) with Matt Fenske (County of Newell) as an alternate. A timeline of the expected process can be found on the Government of Alberta’s website here: Assessment Model Review engagement | Alberta.ca. At this time, a review of Farmland assessment is not part of the process. ARMAA is joined in this process by a number of industry representatives in addition to the RMA, LGAA, AB Munis, City Assessor’s Group, and the Alberta Assessors Association.

A number of members, including ARMAA had concerns with the process and a pause was enacted. During this pause, the engagement process was altered in an attempt to address concerns such:

- Inconsistent expectations as to how positions and input were shared prior to and during meetings, including a lack of clarity as to how written input was reviewed and used by the Government of Alberta.

- Inconsistent minute-taking resulting in key input provided during meetings not being recorded.

- Inconsistent timelines related to meeting frequency, submission of written input in advance of meetings, etc.

- Lack of determined overarching principles being in place prior to technical discussion occurring.

Some members of the Steering Committee wish to defer some overarching discussions, the broad municipal group pushed for the overarching discussions to be resolved in order to establish direction and scope for the technical work. The broad municipal group was not completely successful and some principle discussions will take place later. With that said, ARMAA does see some potentially positive outcomes of the pause.

- Adoption of external facilitation

- More consistent use of written input with standardized templates prior to in-person discussions

- Better timeframes between meetings.

- More opportunity for inclusion of technical experts.

The next steps in the process will focus on the Construction Cost Reporting Guide (CCRG). This will include the participation of a Technical Working Group composed of individuals with specific working knowledge of assessment and the CCRG. ARMAA’s representative on this group is Larry Riep. Larry has been part of the assessment team at Lacombe County for many years and has expertise in industrial assessment. Other assessment individuals from various municipalities are also aiding the overall process through an RMA technical group of which ARMAA is a part.

The CCRG is a core regulation that defines the construction costs that should be included in establishing a base costing. The new CCRG should have four objectives:

- Ensure that the assessment reflects the specifications and characteristics of the regulated property.

- Ensure that the assessment reflects the ad valorum principle.

- Ensure consistency between regulated property assessed using original construction costs and regulated property assessed using the regulated rates in the Minister’s Guidelines.

- Specify the types of abnormal construction costs that are excluded from the assessment.

These processes will be the bulk of 2024 work and lead into future phases in 2025.

POST #3 ARMAA Update on October 17, 2023:

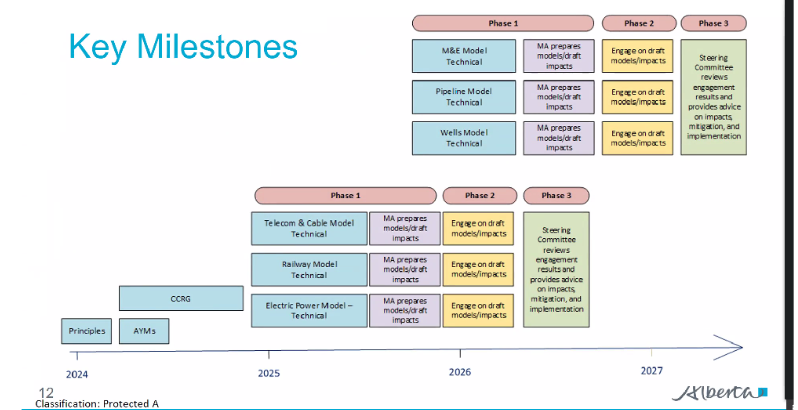

- Principles – Determine guiding principles for assessment and taxation assessment

- CCRG – update and clarify policies

- AYM – principles for how this is determine and applied

- Followed by technical review for each assessment type

- IPPSA – Why was Telecom, Rail and Electrical power models placed ahead of the O&G assets

- MA suggestion following the previous process and have some technical information that could be reused to help scope this review.

- TELUS – Sequencing and impacts on the financial impacts

- Response that Phase 3 would relate to evaluating the tax impacts

- Positioning from O&G groups to move these phases forward as a lot of work has already been done.

- TELUS – Wanting to see if there was an opportunity to work through more work in tandem to reduce timeframe for outcomes. Also, keeping phase 2 work all together to evaluate the total impacts on taxes.

- Discussion around previous process – generally it was suggested that the technical work was sound, and may not require significant updating to move forward.

- AYM

- Proposed path forward is MA will develop a white paper for associations to determine specific impacts of existing and proposed policy changes through written submissions, followed by virtual meetings to discuss

- CCRG

- MA white paper, work with associations to determine key issues

- Technical working group review

- Steering Committee would then review the recommendations from the technical working group, with written confirmation of individual association alignment.

- Need to recognize the difference in services provided at the municipal level in Alberta compared to other jurisdictions

- White papers will provide some discussion around what is in-scope vs out of scope for each white paper.

- Assessment Models

- Review models to update since the last review in 2005

- 3 phase approach for each assessment type

- Phase 1 – White paper outlining known issues, alignment with principles, etc. The technical working group would also provide costs for the specific property type. MA will prepare draft models/draft impacts

- Technical working group could take 6-12 months

- Phase 2 – Reviewed by impacted stakeholders/associations, including taxation impacts and recommend tax-based mitigation strategies

- Phase 3 – Would come back to steering committee to review engagement results and provide advice. Recommendations will relate to assessment models and implementation strategies.

- Phase 1 – White paper outlining known issues, alignment with principles, etc. The technical working group would also provide costs for the specific property type. MA will prepare draft models/draft impacts

- What parts of tax policy should be discussed at this point?

- No 5:1 rate

- Assessments excluded from education tax, etc.

- Consistency of technical information

- Discussion regarding if industry should bring specific costing information to the table for discussion, or should there be a third-party used to obtain all of this data.

- The discussion led towards allowing some industry input, with a third-party acting as somewhat of an audit function to ensure equality among all industries.

- Budget could be a restricting factor in how this can be addressed.

- One potential funding source would be using funding from the DIP mill rate

- Less likely path would be to request that the Minister find the funding to complete this week.

- Next Steps

- MA will draft some additional questions for consideration prior to finalizing the conversation. This should be sent out by Thursday.

- There will be a virtual meeting in 2 weeks, with the intent of reaching consensus on the final items.

- Notes Taken by Jason Wallsmith, CAO MD of Acadia

POST #2 ARMAA Update on May 2022 Meeting

This Committee, which was created by Municipal Affairs, consists of various municipal and industry stakeholders affected by pending and future review of Alberta’s assessment model.

As a response to the gross mismanagement of the recent assessment model review by the GOA, this committee is tasked with designing the terms of engagement, consideration and communication surrounding all future review.

No tangible outcomes regarding the framing of future processes have been attained and are not expected until, at minimum, Q4 of 2022.

For further information, please contact ARMAAs’ committee appointment for the AMR, Tyler Lawrason

POST #1

The Government of Alberta is seeking to reinitiate stakeholder engagement on Alberta’s regulated property assessment model.

Before the ministry engages with municipal and industry stakeholders in discussions around specific assessment issues, Municipal Affairs will be seeking advice from stakeholders on the design of the engagement process. This will include developing the principles, process, and schedule for the broader Assessment Model Review (AMR) engagement review. They intend to establish an AMR Steering Committee to work with them to co-design an engagement plan, which will then be shared with the Minister of Municipal Affairs for his review and approval.

They would like to note that this steering committee will not be discussing the engagement for regulated farmland assessments. A separate steering committee will be established at a later date to discuss these assessments.

ARMAA has chosen Tyler Lawrason to participate in the first meeting of the AMR Steering Committee, which is to be scheduled for late May 2022.